Planning for retirement is one of the most important financial decisions you will ever make. In today’s fast-changing economic landscape, Europeans are seeking smarter, more flexible ways to secure their future. Whether you live in the UK, Germany, France, Italy, or the Netherlands, effective retirement planning services in Europe ensure that you enjoy financial stability and peace of mind during your golden years.

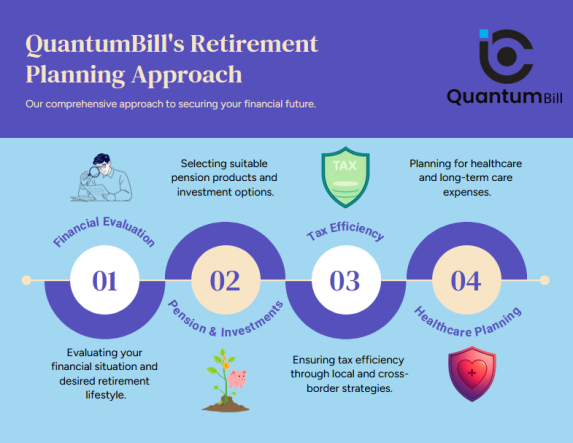

At The Quantum Bill, we specialize in crafting personalized retirement and pension strategies for individuals, professionals, and expatriates across Europe. Our expert advisors combine market knowledge with long-term financial planning techniques to ensure that your post-retirement income supports your lifestyle, healthcare, and legacy goals.

📞 Book Your Free Retirement Consultation Today

Call: +256.200952236 | WhatsApp: +256.200952236

Visit: https://thequantumbill.com and fill the appointment form.

Understanding Retirement Planning in Europe

What Is Retirement Planning?

Retirement planning involves identifying your financial goals for your post-work life and developing strategies to achieve them. It includes saving, investing, and managing your income streams so that you can live comfortably when you are no longer earning a regular salary.

In Europe, with varying pension schemes, tax regulations, and social security systems, having a tailored retirement plan is essential. The Quantum Bill ensures your investments are optimized, taxes are minimized, and your retirement income remains sustainable for decades.

Schedule Your Consultation

1. Pension Planning in Europe

European pension systems vary significantly from one country to another, blending state, occupational, and private pensions. Understanding how these components work together is key to maximizing your benefits.

Types of Pension Schemes in Europe:

- State Pensions: Funded by national governments and based on years of contributions.

- Occupational Pensions: Employer-sponsored plans offering additional retirement income.

- Private Pensions: Personal savings or investments managed by individuals with professional guidance.

Diversifying your portfolio across these markets helps manage risk while maximizing returns.

At The Quantum Bill, our investment experts analyze market trends and create tailored strategies that align with your personal and business goals.

At The Quantum Bill, we assist clients in:

- Reviewing their existing pension arrangements.

- Setting up private pension funds for additional income security.

- Consolidating multiple pension plans into one manageable portfolio.

- Ensuring compliance with EU and national pension regulations.

2. Retirement Income Strategies in Europe

Planning your retirement income strategy ensures that your savings translate into a steady, reliable income once you retire. We help you create diversified income streams that last throughout your retirement.

Popular Retirement Income Options:

- Annuities – Guaranteed income for life or a fixed term.

- Investment Portfolios – Managed funds generating dividend and interest income.

- Real Estate Investments – Rental properties providing consistent cash flow.

- Dividend-paying stocks and bonds.

Our advisors focus on income sustainability, inflation protection, and tax efficiency to ensure you enjoy a stress-free retirement.

3. Private Pension Schemes in Europe

Private pensions have become increasingly popular among European professionals who wish to supplement their state and employer pensions. These individual schemes offer flexibility, control, and potential tax advantages.

Benefits of Private Pension Plans:

- Freedom to choose investment options (stocks, bonds, ETFs, etc.).

- Tax-deferred growth on contributions.

- Ability to adjust contributions and withdrawal timelines.

- Inheritance benefits for beneficiaries.

4. Long-Term Care and Healthcare Planning in Europe

As life expectancy increases across Europe, long-term care planning has become an essential part of retirement strategy. Unexpected healthcare costs can drain retirement savings if not planned for in advance.

We help clients prepare for potential medical expenses by incorporating:

- Health insurance plans for retirees and expats.

- Long-term care insurance covering nursing or assisted living.

- Medical emergency funds for unforeseen situations.

- Cross-border healthcare planning for retirees living abroad.

5. Post-Retirement Investment Planning

Retirement doesn’t mean your money stops working. With smart post-retirement investment planning, you can keep your assets growing while drawing income safely.

We design investment portfolios that:

- Balance income generation with capital preservation.

- Include dividend-paying stocks, bonds, and real estate funds.

- Protect against inflation and currency risks.

- Allow for periodic withdrawals without eroding principal capital.

6. Cross-Border Retirement Planning for Expats in Europe

For expatriates living and working across Europe, managing pensions and retirement benefits across multiple jurisdictions can be complex.

Our cross-border retirement services help you:

- Consolidate pension accounts from multiple countries.

- Avoid double taxation through EU agreements.

- Transfer UK pensions to EU-compliant schemes (QROPS).

- Manage currency exposure and investment diversification.

Whether you’re an EU citizen or a foreign professional retiring in Europe, our advisors ensure your financial security transcends borders.

7. Estate and Legacy Planning for Retirees

Retirement planning also includes estate planning, ensuring your wealth is distributed according to your wishes. We provide guidance on wills, trusts, and inheritance tax efficiency.

Our experts assist in:

- Drafting legally valid wills.

- Setting up family trusts.

- Minimizing inheritance tax obligations.

- Creating charitable giving strategies.

This ensures your legacy benefits your loved ones while reducing administrative and tax burdens.

Why Choose The Quantum Bill for Retirement Planning in Europe

- Pan-European expertise with deep understanding of pension laws and financial systems.

- Personalized planning tailored to your income, goals, and location.

- Tax-efficient retirement solutions compliant with EU regulations.

- End-to-end guidance—from saving and investing to legacy transfer.

Conclusion

At The Quantum Bill, we are dedicated to helping individuals across Europe build reliable retirement plans that grow and protect their wealth. Whether you’re just starting to save or approaching retirement, our experts will help you every step of the way.

Secure your future today

Book a free retirement planning consultation now

Call: +256.200952236 | WhatsApp: +256.200952236

Useful Links

Contact Info

- +256.200952236

- info@thequantumbill.com

- Kololo, Kampala, Uganda

- Hours: Mon–Fri: 9 AM – 5 PM