Financial planning in Europe has evolved far beyond budgeting and savings—it’s now a sophisticated, strategic process designed to help individuals, families, and businesses achieve long-term financial goals. Whether you’re an entrepreneur in Berlin, an expat in Paris, or a professional in London, proper financial planning ensures that your wealth is managed efficiently, protected, and positioned for growth.

At The Quantum Bill, we offer comprehensive financial planning services tailored to the European market—integrating tax efficiency, investment management, retirement planning, and estate preservation to help you create sustainable wealth.

📞 Book Your Free Financial Consultation Today

Call: +256.200952236 | WhatsApp: +256.200952236

Visit: https://thequantumbill.com and fill out the appointment form.

Understanding Financial Planning Services in Europe

What Is Financial Planning?

Financial planning is the process of assessing your current financial position, setting goals, and implementing strategies to achieve them. It includes budgeting, saving, investing, managing debt, and planning for retirement or future milestones.

In Europe, where the financial ecosystem is diverse and highly regulated, professional financial planners play an essential role in helping clients:

Schedule Your Consultation Now

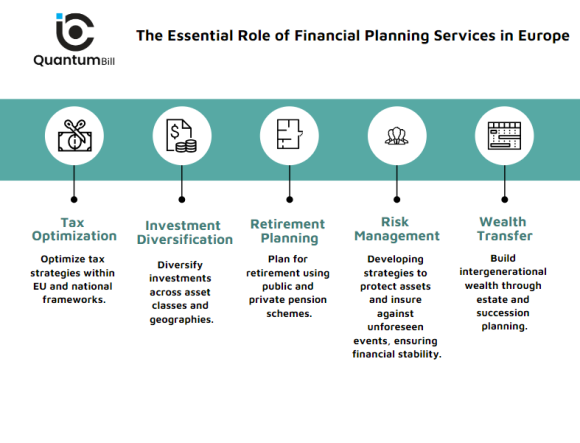

Key Components of Financial Planning Services in Europe

1. Investment Planning and Portfolio Management

Investment planning forms the foundation of financial growth. European investors have access to a wide range of instruments, including mutual funds, ETFs, equities, bonds, and real estate investment trusts (REITs).

A personalized investment strategy involves:

- Setting clear financial goals and risk tolerance.

- Diversifying portfolios across European and global markets.

- Monitoring performance and rebalancing regularly.

- Incorporating ESG (Environmental, Social, and Governance) investments to align with ethical standards.

At The Quantum Bill, we develop diversified investment portfolios that balance risk and reward—designed for both short-term gains and long-term stability.

2. Tax-Efficient Wealth Management

Europe’s tax landscape varies widely, making tax planning a key component of financial management. From France’s wealth tax to the UK’s capital gains tax, understanding the nuances is critical.

Effective tax planning strategies include:

- Utilizing tax-advantaged accounts like ISAs (UK), PEA (France), or pension funds.

- Structuring investments in jurisdictions with favorable tax treaties.

- Leveraging deductions and allowances to minimize liabilities.

Professional financial planners ensure your portfolio remains compliant while optimizing after-tax returns.

3. Retirement and Pension Planning

Europe offers a mix of public and private pension systems, but relying solely on state pensions is risky. Financial advisors help clients build private pension plans that complement statutory benefits.

Key pension options include:

- Occupational pensions – Employer-sponsored contributions.

- Personal pension schemes – Individual savings plans with tax incentives.

- Investment-linked annuities – Ensuring guaranteed income post-retirement.

Our team at The Quantum Bill crafts personalized retirement plans tailored to your lifestyle goals, ensuring financial independence in your golden years.

4. Risk Management and Insurance Planning

Financial planning isn’t complete without risk management. Life’s uncertainties—illness, job loss, or market downturns—can threaten financial stability.

Insurance planning helps mitigate such risks through:

- Life and disability insurance to protect dependents.

- Health and long-term care insurance for medical emergencies.

- Asset protection insurance for property and business holdings.

By integrating insurance within your financial plan, you safeguard your wealth and ensure continuity for your family and business.

5. Estate and Legacy Planning

Estate planning ensures a smooth transfer of assets to your heirs while minimizing taxes and legal complications. In Europe, where inheritance laws differ by country, it’s essential to have a structured estate plan that includes:

- Drafting wills in compliance with EU Succession Regulation.

- Setting up trusts to protect and manage wealth efficiently.

- Managing cross-border inheritance and tax obligations.

At The Quantum Bill, we help you preserve your legacy through personalized estate strategies that reflect your values and long-term family goals.

6. Financial Planning for Expats in Europe

Expats face unique challenges—currency fluctuations, differing tax laws, and pension portability. Professional advisors help manage these complexities through:

- Cross-border investment planning.

- Expat retirement and pension advice.

- Tax optimization between home and host countries.

Whether you’re an East African professional working in Europe or a European relocating abroad, The Quantum Bill offers specialized expat financial planning services to help you stay financially confident and compliant.

Why Choose The Quantum Bill for Financial Planning Services in Europe

- Personalized financial strategies for individuals, families, and businesses.

- Global expertise in East African and European markets.

- Transparent advice based on data and regulatory compliance.

- Commitment to long-term financial success.

Conclusion

Let’s build your financial future

Book a free consultation today

Call: +256.200952236 | WhatsApp: +256.200952236

Useful Links

Contact Info

- +256.200952236

- info@thequantumbill.com

- Kololo, Kampala, Uganda

- Hours: Mon–Fri: 9 AM – 5 PM