Estate planning in Europe has evolved far beyond simply writing a will. With complex inheritance tax laws, cross-border property ownership, and international family arrangements, having a well-structured estate plan is essential. Whether you reside in the UK, Germany, France, Spain, or Eastern Europe, estate planning ensures your assets are protected, taxes are minimized, and your loved ones are financially secure.

At The Quantum Bill, we provide tailored estate planning services in Europe—combining financial strategy, legal expertise, and cross-border knowledge to create plans that work seamlessly across multiple jurisdictions.

📞 Book Your Free Estate Planning Consultation Today

Call: +256.200952236 | WhatsApp: +256.200952236

Visit: https://thequantumbill.com and fill the appointment form.

1. Estate Planning Lawyer Europe

An estate planning lawyer in Europe helps clients manage their wealth efficiently and ensures a smooth transfer of assets to heirs. Given Europe’s diverse legal frameworks, having expert legal guidance is crucial to prevent disputes, avoid unnecessary taxes, and ensure full compliance with European inheritance laws.

Key services provided by estate planning lawyers include:

- Drafting wills, trusts, and living wills.

- Advising on inheritance and estate tax regulations.

- Managing cross-border assets and offshore holdings.

- Handling family succession and inheritance disputes.

2. Inheritance Tax Planning in Europe

Inheritance tax (IHT) is one of the biggest challenges in estate planning across Europe. Countries like France, Germany, and the UK impose taxes on wealth transfers that can reach up to 45% or more. Without strategic planning, your beneficiaries may lose a large portion of their inheritance to taxation.

Effective inheritance tax planning strategies include:

- Setting up family trusts or foundations to reduce taxable estate value.

- Lifetime gifting to minimize the estate’s taxable size.

- Using tax-efficient investments and insurance policies to offset liabilities.

- Leveraging double taxation treaties between countries.

At The Quantum Bill, our advisors help you design a tax-efficient estate structure that complies with European tax laws while protecting your legacy.

Secure Your Future Now

3. Cross-Border Inheritance Europe

Europe’s integration under the EU Succession Regulation (Brussels IV) allows individuals to choose which country’s laws apply to their estate. However, this flexibility adds complexity for expats, dual citizens, and investors with assets in multiple countries.

Common challenges in cross-border inheritance include:

- Conflicting inheritance laws between jurisdictions.

- Forced heirship rules (e.g., in France or Spain).

- Double taxation risks.

- Currency exchange and property valuation issues.

Our estate planning experts provide cross-border inheritance planning to ensure your global assets are distributed seamlessly, no matter where they are located. We work closely with legal partners across the EU, UK, and beyond to deliver compliance-driven solutions.

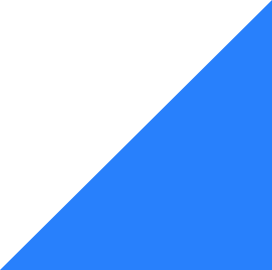

4. Wills and Trusts Europe

Drafting a will or establishing a trust is fundamental to any estate plan. A properly executed will ensures your wishes are respected, while a trust provides greater flexibility, privacy, and control over how your assets are managed and distributed.

Trusts can also serve as tax-efficient vehicles for wealth transfer, particularly in countries with high inheritance taxes.

5. Probate Services Europe

Probate refers to the legal process of validating a will and transferring the deceased’s assets to beneficiaries. Depending on the jurisdiction, probate can take months or even years if not managed properly.

Our probate administration services ensure:

- Timely legal validation of wills.

- Transparent management of estate assets.

- Communication between executors and beneficiaries.

- Resolution of legal or tax-related disputes.

We simplify the probate process across different European countries by working with local authorities, banks, and legal institutions.

6. Business and Family Succession Planning

Our succession planning services help business owners:

- Identify successors and leadership structures.

- Draft shareholder agreements and succession clauses.

- Minimize capital gains and inheritance taxes.

- Ensure governance and smooth operational transitions.

At The Quantum Bill, we help you preserve your legacy through personalized estate strategies that reflect your values and long-term family goals.

7. Philanthropy and Charitable Estate Planning in Europe

Many high-net-worth individuals wish to create lasting legacies through charitable giving. We help design philanthropic estate plans that align with your values and goals while providing tax advantages.

Philanthropy planning includes:

- Setting up charitable foundations or trusts.

- Endowments for education, healthcare, or environment.

- Structuring donations for maximum impact and transparency.

- Managing charitable investments under ESG principles.

8. Digital Estate Planning in Europe

In today’s digital age, your online assets—cryptocurrency wallets, domain names, and digital business platforms—are also part of your estate. Digital estate planning ensures your online wealth is secured and transferred according to your wishes.

We help clients:

- Catalogue and manage digital assets.

- Secure passwords and digital access rights.

- Ensure crypto and investment platforms are properly included in estate plans.

Why Choose The Quantum Bill for Estate Planning in Europe

- Expertise across multiple European jurisdictions.

- Cross-border legal, tax, and financial coordination.

- Personalized strategies for individuals, families, and business owners.

- Integration with wealth management and investment services.

- Transparent, ethical, and client-focused approach.

Conclusion

Plan for your future today

Schedule your free estate consultation now

Call: +256.200952236 | WhatsApp: +256.200952236

Useful Links

Contact Info

- +256.200952236

- info@thequantumbill.com

- Kololo, Kampala, Uganda

- Hours: Mon–Fri: 9 AM – 5 PM