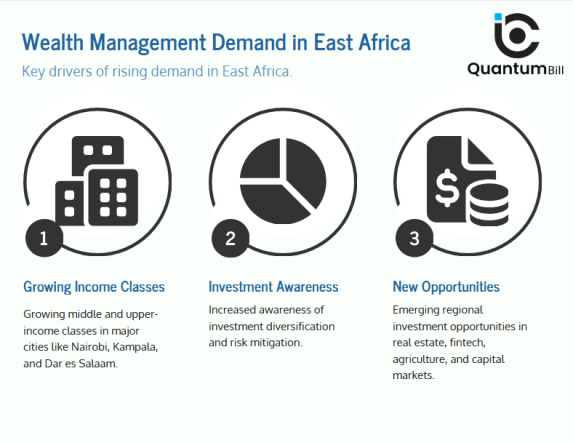

East Africa’s financial landscape is transforming rapidly. With rising incomes, expanding investment opportunities, and an increasingly sophisticated investor base, wealth management services have become essential for individuals and businesses looking to build, grow, and safeguard their wealth.

Whether you are an entrepreneur in Kenya, a professional in Uganda, an investor in Tanzania, or a business owner in Rwanda, effective wealth management provides the strategic direction needed to secure your financial future.

At The Quantum Bill, we provide comprehensive wealth management solutions tailored to the East African market—combining financial planning, investment management, estate planning, and tax optimization into one integrated approach.

📞 Book Your Free Wealth Consultation Today

Call: +256.200952236 | WhatsApp: +256.200952236

Visit: https://thequantumbill.com and fill the appointment form.

Understanding Wealth Management in East Africa

What Is Wealth Management?

Wealth management is a holistic approach to financial growth and protection. It involves strategic planning, smart investing, and long-term financial management that ensures your wealth not only grows but is also preserved across generations.

In East Africa, the demand for wealth management services is rising due to:

Schedule Your Consultation

Core Wealth Management Services in East Africa

1. Investment Management and Portfolio Diversification

Investment management is the backbone of wealth creation. In East Africa, opportunities exist in diverse asset classes such as:

- African stock markets (Nairobi Securities Exchange, Dar es Salaam Stock Exchange, Uganda Securities Exchange).

- Fixed-income securities – Treasury bonds and corporate debt.

- Alternative investments – Real estate, private equity, and agribusiness.

- Unit trusts and mutual funds – Professionally managed collective investments.

Diversifying your portfolio across these markets helps manage risk while maximizing returns.

At The Quantum Bill, our investment experts analyze market trends and create tailored strategies that align with your personal and business goals.

2. Financial Planning and Wealth Structuring

Financial planning is the foundation of long-term wealth management. Our advisors help you:

- Set short- and long-term financial goals.

- Manage cash flow, savings, and debt.

- Build retirement and education funds.

- Structure your wealth to ensure tax efficiency and asset protection.

A personalized financial plan gives clarity on where your money is going and how to make it work harder for you.

3. Estate Planning and Succession Management

Wealth is not only about accumulation—it’s about preservation. Estate planning ensures that your assets are distributed according to your wishes while minimizing taxes and legal disputes.

Services include:

- Drafting wills and trusts.

- Setting up family offices and wealth transfer structures.

- Managing cross-border inheritance and probate processes.

As more East Africans acquire international assets, estate planning has become a critical aspect of wealth management.

4. Risk Management and Insurance Planning

Risk management safeguards your wealth against unexpected events such as market downturns, health emergencies, or business disruptions.

Our advisors help you create customized protection plans that may include:

- Life and health insurance for personal and family security.

- Business continuity insurance for entrepreneurs.

- Investment risk analysis to maintain stable portfolio performance.

Through careful risk assessment and planning, you can achieve financial resilience even in uncertain economic times.

5. Tax and Compliance Advisory

Navigating tax regulations across East Africa requires expertise. Each country—Kenya, Uganda, Tanzania, and Rwanda—has its own tax laws governing investments, businesses, and inheritance.

- Optimize tax exposure on investment income and capital gains.

- Comply with local tax regulations while maximizing returns.

- Leverage double taxation agreements for cross-border income.

Our goal is to ensure full compliance while keeping your financial plan tax-efficient.

6. Retirement and Pension Advisory Services

With increasing life expectancy, retirement planning has become an integral part of wealth management in East Africa.

- Building retirement investment portfolios.

- Managing contributions to national and private pension schemes.

- Structuring annuities and post-retirement income plans.

By combining retirement planning with wealth management, you ensure a steady and reliable income even after leaving the workforce.

Why Choose The Quantum Bill for Wealth Management in East Africa

- Regional expertise across Kenya, Uganda, Tanzania, and Rwanda.

- Global perspective with access to European and international markets.

- Personalized solutions based on your unique goals.

- Comprehensive wealth management from investments to inheritance planning.

Conclusion

At The Quantum Bill, we combine local insight with global financial expertise to deliver customized wealth management services designed for East Africans who aspire to build and preserve lasting wealth.

Start building your wealth today

Book a free consultation now

Call: +256.200952236 | WhatsApp: +256.200952236

Useful Links

Contact Info

- +256.200952236

- info@thequantumbill.com

- Kololo, Kampala, Uganda

- Hours: Mon–Fri: 9 AM – 5 PM